Page 145 - enav_27052016

P. 145

ENAV Group Consolidated Financial Statements

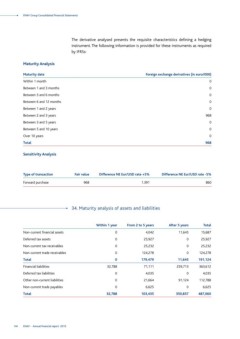

Maturity Analysis The derivative analysed presents the requisite characteristics defining a hedging

instrument. The following information is provided for these instruments as required

Maturity date by IFRSs:

Within 1 month

Between 1 and 3 months Foreign exchange derivatives (in euro/000)

Between 3 and 6 months 0

Between 6 and 12 months 0

Between 1 and 2 years 0

Between 2 and 3 years 0

Between 3 and 5 years 0

Between 5 and 10 years

Over 10 years 968

Total 0

0

Sensitivity Analysis 0

968

Type of transaction Fair value Difference NE Eur/USD rate +5% Difference NE Eur/USD rate -5%

Forward purchase 968 1.391 860

34. Maturity analysis of assets and liabilities

Non-current financial assets Within 1 year From 2 to 5 years After 5 years Total

Deferred tax assets 0 4,042 11,645 15,687

Non-current tax receivables 0 0 25,927

Non-current trade receivables 0 25,927 0 25,232

Total 0 25,232 0 124,278

Financial liabilities 0 124,278 11,645 191,124

Deferred tax liabilities 179,479 363,612

Other non-current liabilities 32,788 71,111 259,713

Non-current trade payables 0 0 4,035

Total 0 4,035 112,788

0 21,664 91,124

0 6,625

32,788 6,625 487,060

103,435 350,837

144 ENAV - Annual financial report 2015