Page 222 - enav_27052016

P. 222

ENAV S.p.A. Financial Statement

project for new technology and procedures associated with air transport, where

ENAV plays a coordinating role. The decrease for the period relates to the portion

reversed to the Income Statement regarding the amortisations of the investments

that the grant referred to for € 105 thousand and the portion classified under other

current liabilities for € 128 thousand.

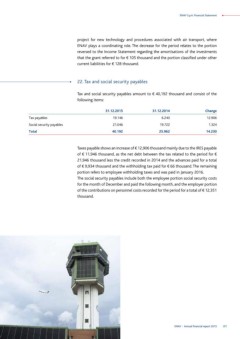

22. Tax and social security payables

Tax and social security payables amount to € 40,192 thousand and consist of the

following items:

Tax payables 31.12.2015 31.12.2014 Change

Social security payables 19.146 6.240 12.906

Total 21.046

40.192 19.722 1.324

25.962 14.230

Taxes payable shows an increase of € 12,906 thousand mainly due to the IRES payable

of € 11,946 thousand, as the net debt between the tax related to the period for €

21,946 thousand less the credit recorded in 2014 and the advances paid for a total

of € 9,934 thousand and the withholding tax paid for € 66 thousand. The remaining

portion refers to employee withholding taxes and was paid in January 2016.

The social security payables include both the employee portion social security costs

for the month of December and paid the following month, and the employer portion

of the contributions on personnel costs recorded for the period for a total of € 12,351

thousand.

ENAV - Annual financial report 2015 221