Page 136 - enav_27052016

P. 136

ENAV Group Consolidated Financial Statements

Financial income increased by € 4,885 thousand in total attributable mainly to the

income from the reversal of discounting of the balance following the adjustment to

the present value on the related receivables recorded for the changes to the charge

recovery plan, in accordance with the performance plan 2015–2019. This change

amounts to € 2,111 thousand, whereas the remaining amount of € 2,332 thousand

refers to the portion of financial income relating to 2015. Other interest income

largely refers to default interest applicable to airline companies for late payment

charges.

The income from investments in other companies refers to the dividend paid by the

French investee, ESSP, as was the case in the previous period.

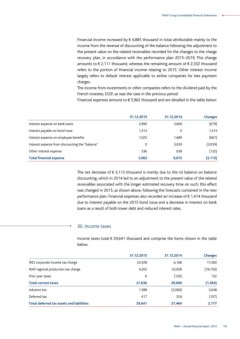

Financial expenses amount to € 5,962 thousand and are detailed in the table below:

Interest expense on bank loans 31.12.2015 31.12.2014 Changes

Interest payable on bond issue 2,990 3,669 (679)

Interest expense on employee benefits 1,414 0 1,414

Interest expense from discounting the “balance” 1,022 1,689 (667)

Other interest expense 0 3,059

Total financial expense 536 658 (3,059)

5,962 9,075 (122)

(3,113)

The net decrease of € 3,113 thousand is mainly due to the nil balance on balance

discounting, which in 2014 led to an adjustment to the present value of the related

receivables associated with the longer estimated recovery time on such; this effect

was changed in 2015, as shown above, following the forecasts contained in the new

performance plan. Financial expenses also recorded an increase of € 1,414 thousand

due to interest payable on the 2015 bond issue and a decrease in interest on bank

loans as a result of both lower debt and reduced interest rates.

30. Income taxes

Income taxes total € 29,641 thousand and comprise the items shown in the table

below:

IRES corporate income tax charge 31.12.2015 31.12.2014 Changes

IRAP regional production tax charge 23,428 6,168 17,260

Prior year taxes 4,202

Total current taxes 6 22,958 (18,756)

Advance tax 27,636 (126) 132

Deferred tax 1,588

Total deferred tax assets and liabilities 417 29,000 (1,364)

29,641 (2,060) 3,648

(107)

524 2,177

27,464

ENAV - Annual financial report 2015 135